Welcome to Homeseed’s Mortgage Market Update, where we dive into the latest trends, insights, and changes shaping the dynamic landscape of the housing and lending industries.

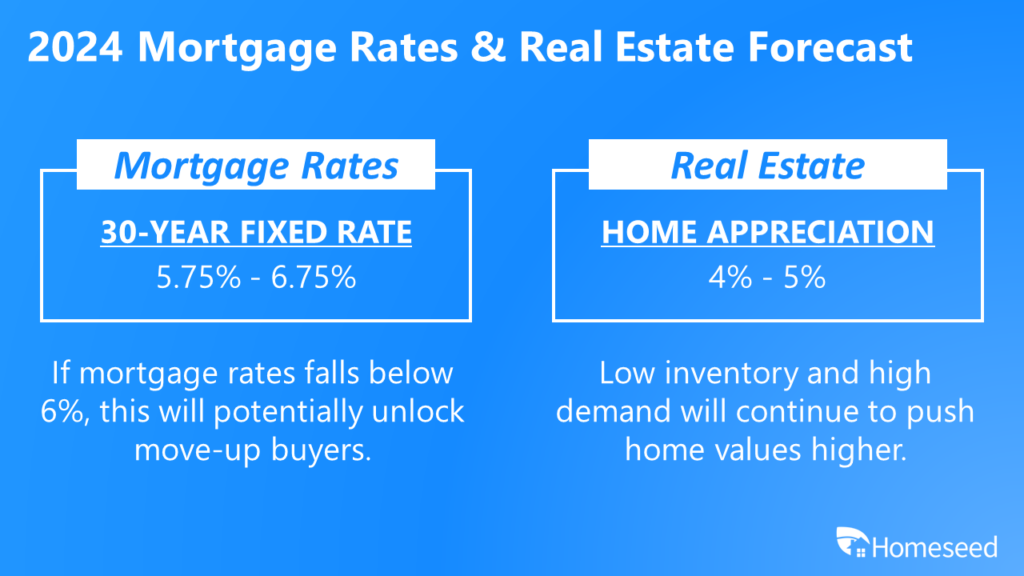

Mortgage Rate Trends & Forecasts

- Mortgage rates are higher this week as a result of strong labor market and manufacturing data.

- The BLS Jobs Report showed nearly double the amount of jobs were added to the market than expected.

- The ISM Non-Manufacturing PMI was also higher than expected and the upbeat economic data put additional upward pressure on rates.

BLS Jobs Report

- The report for January showed that the 353,000 jobs created were nearly double the expected 180,000.

- One thing to be mindful of is that January is a month of heavy adjustments due to new benchmarks, seasonal adjustments, and population controls.

- Despite the job gains, the entire labor force is working on average 30 minutes less per week, which is equivalent to 2.4M jobs lost.

- We will have to wait for February data to see if the labor market tightening once again.

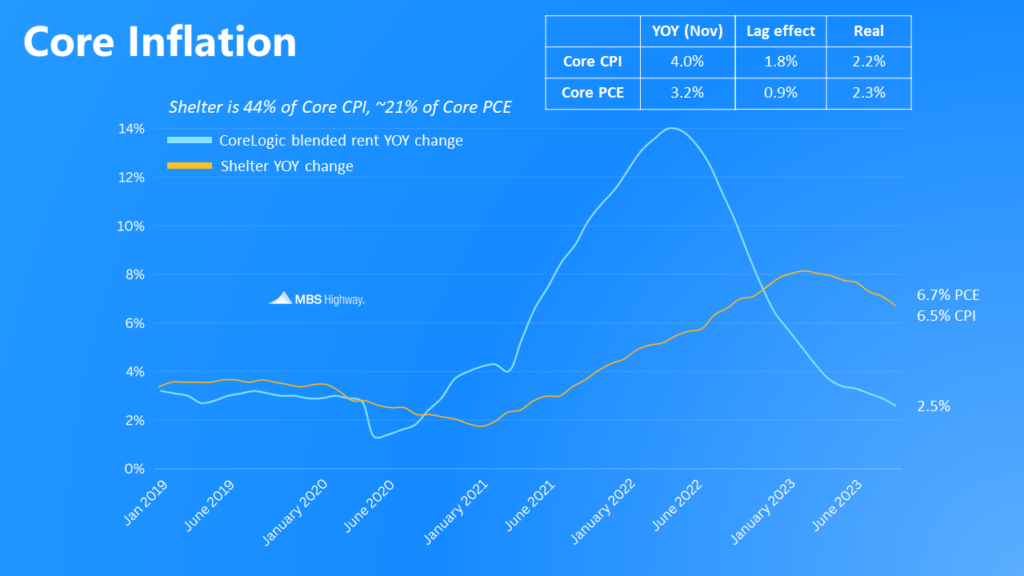

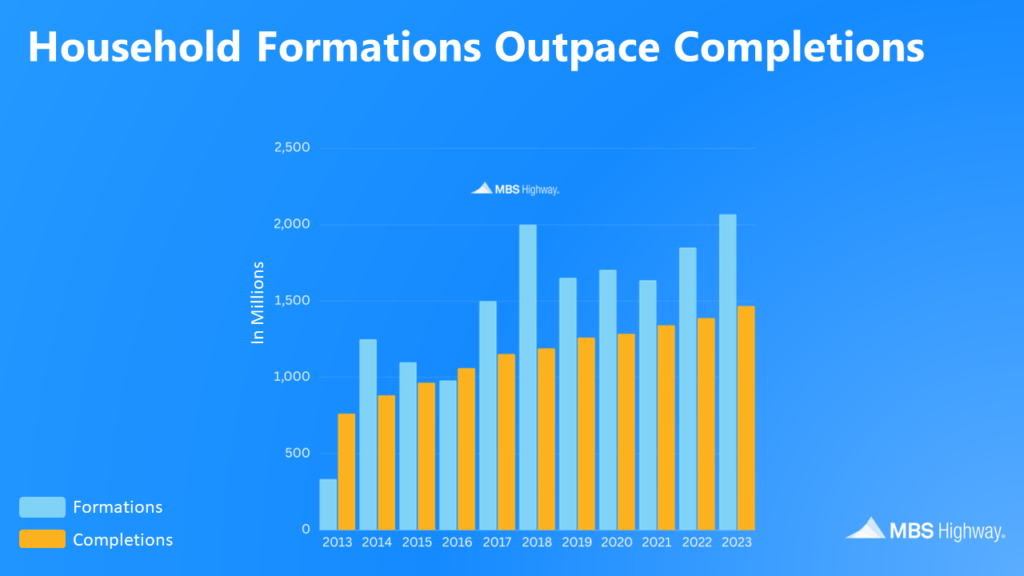

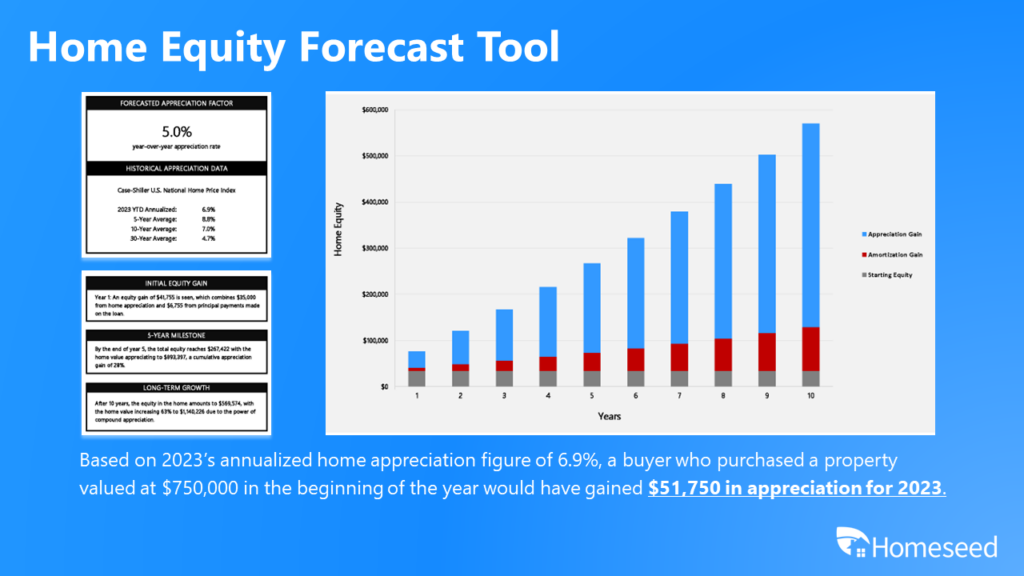

Home Values Continue to Appreciate

- The two most notable housing indices, Case-Shiller and FHFA, both recently released data showing that home prices set new highs.

- Although data for December 2023 is not available yet, both indices show that home values were on pace to appreciate by 6% in 2023.

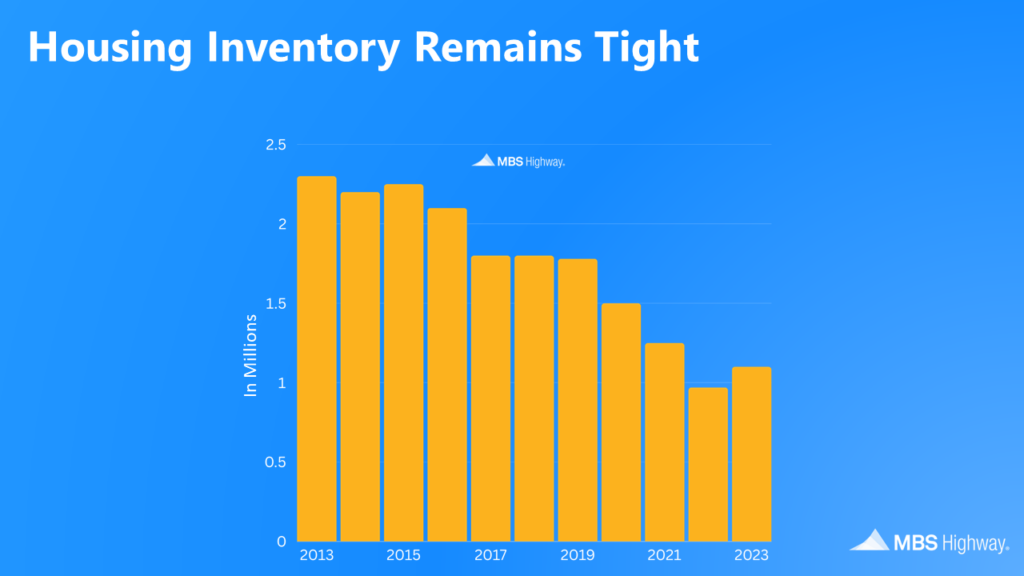

- Lower numbers for existing inventory and active listings will continue to be supportive of home prices throughout 2024.

- RATES MOVE HIGHER – Upbeat economic reports provide the catalyst for higher week-over-week rates.

https://www.mortgagenewsdaily.com/… - MEDIA SAYING HOUSING CRASH – But housing credit data today looks nothing like what was seen in 2008.

https://www.housingwire.com/… - BOOST TO HOUSING SENTIMENT – The Fannie Mae Home Purchase Sentiment Index reached its highest level in nearly two years.

https://www.fanniemae.com/… - TWO SIDES TO JOB MARKET – Economists and reports say the labor market is strong, but job seekers don’t share the same confidence.

https://www.cnbc.com/…